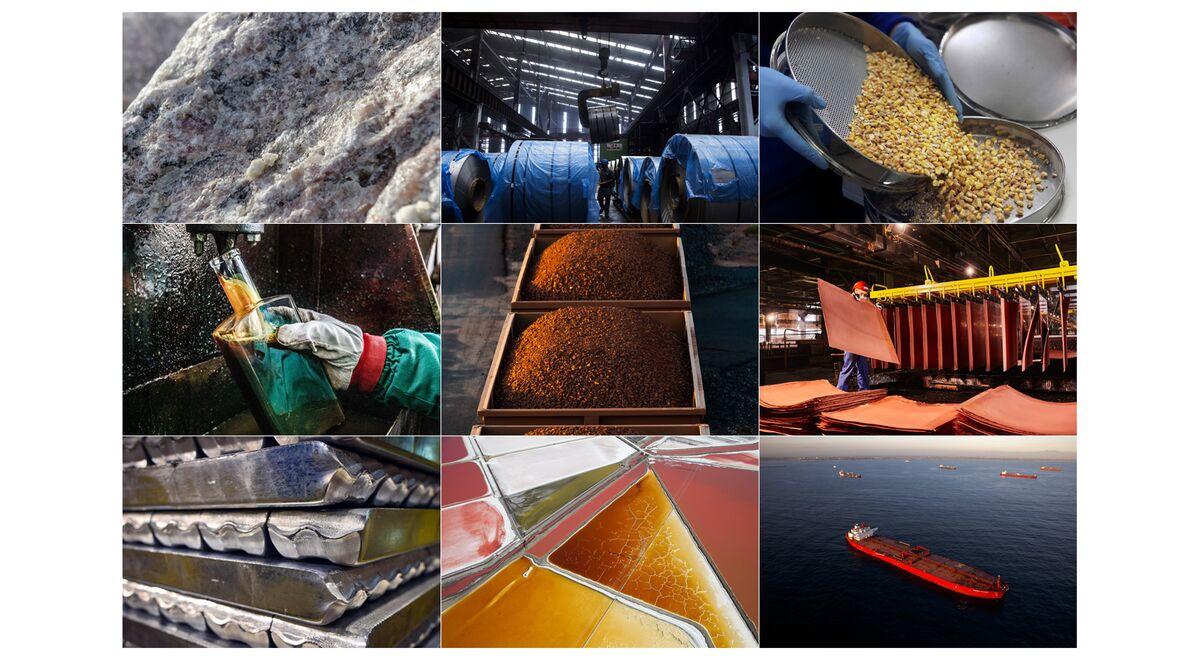

Commodity prices play a pivotal role in shaping the dynamics of the global economy, influencing everything from inflation rates to the cost of living for individuals and the profitability of businesses. Commodity prices refer to the market values of raw materials, such as oil, gold, agricultural products, and metals, which are essential inputs for various industries worldwide. The impact of commodity price fluctuations can be far-reaching, affecting both developed and developing economies in unique ways.

One of the primary channels through which commodity prices affect the global economy is inflation. When the prices Commodity Prices Impact of essential commodities rise, it often leads to an increase in the overall price level of goods and services. This phenomenon, known as commodity-driven inflation, can erode the purchasing power of consumers, making everyday items more expensive. Central banks closely monitor commodity prices as part of their efforts to control inflation rates through monetary policy tools like interest rates.

Oil prices, in particular, have a profound impact on the global economy. As a critical energy source, oil is a fundamental input for transportation, manufacturing, and various other industries. When oil prices surge, it results in higher production costs for businesses, leading to increased prices for goods and services. Additionally, higher oil prices contribute to transportation cost hikes, affecting the prices of goods throughout the supply chain. This can trigger a chain reaction, ultimately impacting consumer spending patterns and economic growth.

Commodity prices also influence the trade balances of nations. Countries that heavily rely on commodity exports, such as those exporting oil or agricultural products, are particularly susceptible to fluctuations in commodity prices. A sudden drop in prices can negatively impact the revenues of these exporting nations, leading to trade deficits and economic challenges. Conversely, countries that are significant importers of commodities may benefit from lower prices, as it reduces their import bills and trade deficits.

Investment markets are another arena where commodity prices exert a substantial influence. Commodity markets are volatile by nature, and their fluctuations can create opportunities and risks for investors. For instance, during periods of economic uncertainty or geopolitical tensions, investors often flock to commodities like gold as a safe-haven asset, driving up its price. On the other hand, a glut in commodity supplies or changes in global demand can lead to sharp declines in prices, affecting the profitability of commodity-focused investments.

The impact of commodity prices extends beyond financial markets and trade balances; it also affects the livelihoods of individuals, particularly those in developing economies heavily dependent on agriculture. Fluctuations in agricultural commodity prices can significantly impact the income of farmers, affecting their ability to support their families and invest in their communities. This, in turn, can have broader implications for food security and social stability in these regions.

In conclusion, commodity prices are a crucial driver of the global economy, influencing inflation, trade balances, investment markets, and the well-being of individuals worldwide. The interconnectedness of the global economy means that changes in commodity prices have ripple effects that can be felt across borders and industries. As such, policymakers, businesses, and investors must closely monitor and adapt to the dynamics of commodity markets to navigate the challenges and opportunities they present.